ThreatFabric researchers have uncovered a sophisticated new campaign involving the Anatsa Android banking trojan, marking a significant escalation in cybercriminal activities targeting mobile banking customers across the United States and Canada.

This latest operation represents the third documented instance of Anatsa’s focused assault on North American financial institutions, demonstrating the malware’s persistent evolution and geographical expansion.

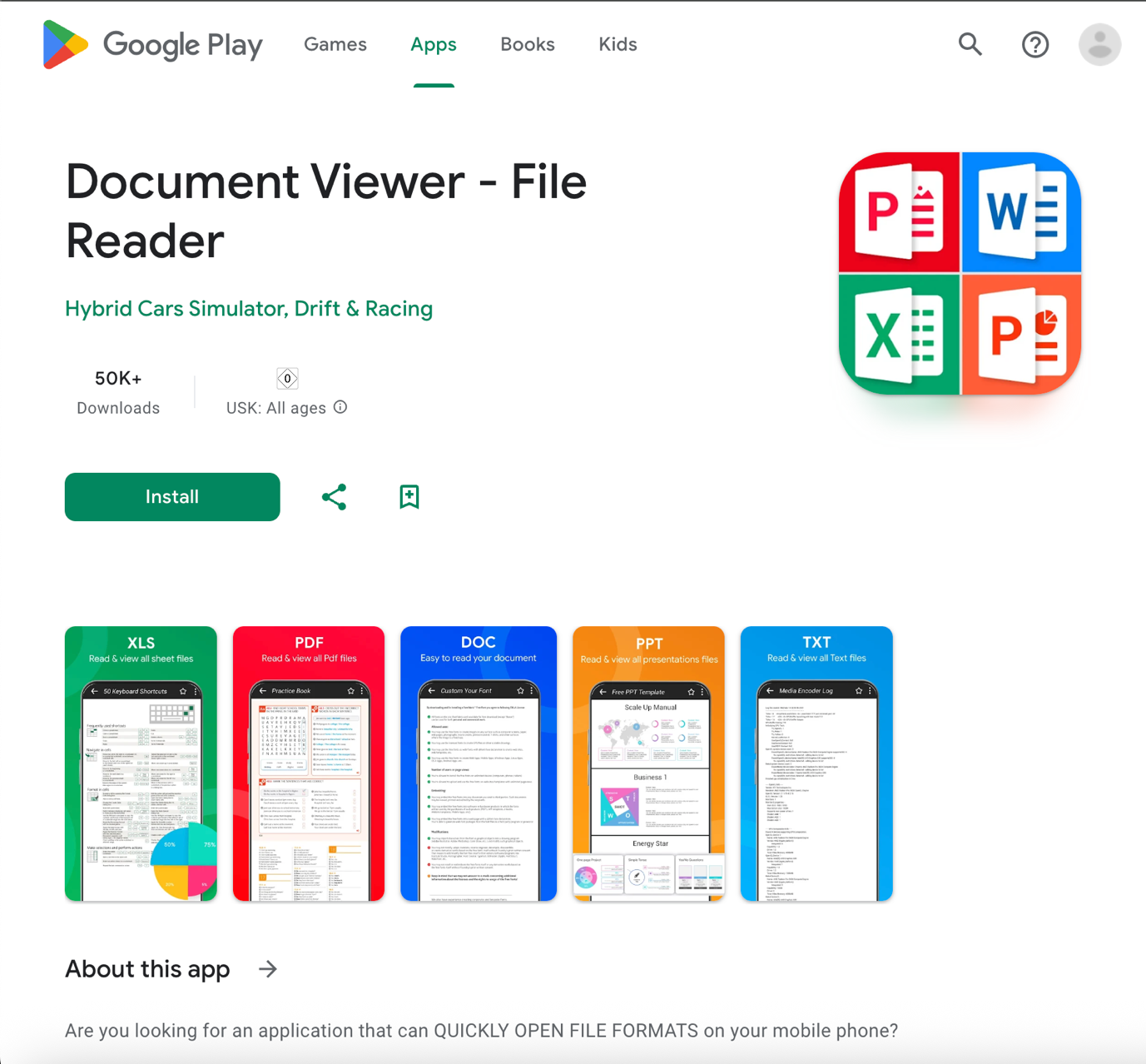

The campaign’s distribution through the official Google Play Store underscores the growing sophistication of mobile banking threats and the challenges faced by security researchers in protecting consumers from increasingly deceptive malicious applications.

Anatsa stands as one of the most sophisticated device-takeover trojans in the current mobile crimeware landscape, equipped with extensive capabilities that make it particularly dangerous to banking customers.

The malware’s operational methodology follows a predictable yet effective pattern that has proven successful across multiple campaigns:

- Initial Legitimacy: Developers establish legitimate profiles on app stores and upload seemingly benign applications such as PDF readers, phone cleaners, file managers, or other generic utility tools that function entirely as advertised during their initial phase.

- User Base Building: These applications build user trust and accumulate substantial download numbers, typically reaching thousands or tens of thousands of downloads before revealing their malicious nature.

- Malicious Update Deployment: Once significant user adoption is achieved, operators deploy malicious updates that embed harmful code into the previously legitimate software.

- Trojan Installation: The embedded malicious code serves as a delivery mechanism for Anatsa, downloading and installing the trojan as a separate application on the infected device.

- Dynamic Targeting: The malware receives targeting information from its command-and-control server, which can be updated dynamically to focus on specific financial institutions and banking applications.

- Fraudulent Activities: Depending on designated targets, Anatsa performs various malicious activities, including credential theft for account takeover, comprehensive keylogging, or fully automated fraudulent transactions.

ThreatFabric has been monitoring Anatsa’s activities since 2020, recognizing the group behind it as among the most prolific operators in mobile cybercrime, with campaigns consistently demonstrating high success rates.

Anatsa Android Banking Via Google Play

The latest Anatsa campaign targeting North America demonstrates the group’s expanding geographical ambitions and refined operational tactics.

The malicious payload was strategically deployed under the guise of a “PDF Update” within a file reader dropper application, leveraging users’ trust in routine software updates.

The dropper application achieved remarkable visibility within the competitive app marketplace, ranking among the top three applications in the “Top Free Tools” category on the official US Google Play Store before its eventual removal.

By the time security researchers and Google’s review team identified and removed the malicious application, it had accumulated over 50,000 downloads, representing a significant pool of potentially compromised devices.

The campaign followed Anatsa’s established modus operandi precisely, initially launching as a completely legitimate application before transforming into a malicious distribution vector approximately six weeks after its initial release.

This timing strategy allows operators to build user trust and achieve substantial download numbers before revealing the application’s true malicious nature.

The distribution window for this particular campaign was notably short yet highly impactful, running from June 24 to June 30.

This compressed timeline suggests either improved detection capabilities by security researchers or a deliberate strategy by the operators to maximize impact while minimizing exposure to detection systems.

The campaign’s success highlights the effectiveness of Anatsa’s cyclical activity pattern, which alternates between periods of active distribution and dormancy, allowing operators to evade detection while maintaining consistently high success rates.

Deceptive Overlay Techniques

Analysis of the latest campaign reveals sophisticated deceptive techniques employed by Anatsa to obscure its malicious activities and prevent detection.

When users attempt to access their banking applications, the malware displays a convincing overlay message that reads: “Scheduled Maintenance – We are currently enhancing our services and will have everything back up and running shortly. Thank you for your patience.” This carefully crafted message serves dual purposes in the attackers’ strategy.

The overlay message effectively obscures malicious activity occurring within the targeted banking application while simultaneously preventing users from contacting customer support services.

By convincing users that their banking application is temporarily unavailable due to routine maintenance, the overlay delays detection of fraudulent operations and provides attackers with additional time to complete unauthorized transactions.

This technique demonstrates the psychological manipulation tactics employed by modern cybercriminals to exploit user trust and expectations.

Financial institutions and their customers must remain vigilant against these evolving threats, particularly given Anatsa’s demonstrated ability to adapt and expand its targeting capabilities across different geographical regions and banking platforms.

Find this Story Interesting! Follow us on Google News, LinkedIn, and X to Get More Instant updates