Threat actors have made alarming claims regarding an extensive data breach affecting HSBC USA customers, alleging access to a massive database containing highly sensitive personally identifiable information (PII) and financial records.

According to reports from Dark Web Intelligence, the threat actors claim to possess customer data, including Social Security numbers (SSNs), bank account numbers, and account balances, among other confidential details.

The Breach Allegations

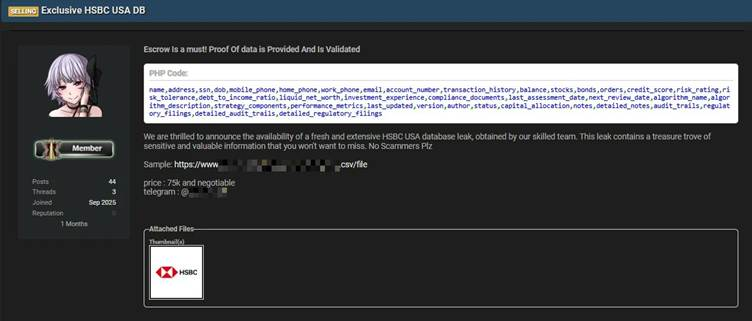

The threat actor announcement surfaced on dark web forums, where individuals claiming responsibility for the breach have publicized details about the compromised customer database.

The scope of the alleged breach encompasses a significant portion of HSBC USA’s customer base, with the threat actors suggesting they have obtained comprehensive financial profiles.

This includes not only account identifiers but also sensitive information such as account balances, transaction histories, and personal identification numbers that could enable account takeovers or identity theft.

The alleged breach represents a critical vulnerability in the banking sector’s defenses, raising serious concerns about data protection standards and the adequacy of security measures employed by major financial institutions.

If verified, this incident would represent one of the most significant breaches of a major international bank in recent years, with potentially millions of customers affected by the exposure of their most sensitive financial and personal information.

The exposure of SSNs, account numbers, and financial details creates a severe risk for affected customers.

With this combination of personal and financial data, threat actors could potentially execute a range of fraudulent activities, including unauthorized account access, identity theft, fraudulent loan applications, and credit card fraud.

Customers whose information has been compromised face an extended period of vulnerability, as SSNs can be exploited for decades to commit identity-based crimes.

HSBC USA has not yet issued an official statement regarding the specific allegations, though major banks typically initiate comprehensive investigations when breach claims surface.

Financial institutions are generally required to notify affected customers and relevant regulatory agencies within specific timeframes under federal law, particularly regarding breaches involving SSNs or financial account information.

Security researchers and threat intelligence analysts are actively investigating the claims to verify the authenticity of the breach and the legitimacy of the threat actor’s access to the data.

The investigation will focus on determining the attack vector used to compromise customer information and the extent of the breach.

Such breaches trigger regulatory scrutiny from federal banking agencies and trigger mandatory breach notification protocols under laws, including the Gramm-Leach-Bliley Act and state data protection regulations.

The incident underscores ongoing challenges facing financial institutions in protecting customer data against sophisticated cyber threats and will likely result in increased focus on security compliance and data protection standards within the banking sector.

Customers of HSBC USA should remain vigilant for suspicious account activity and consider placing fraud alerts or credit freezes to protect themselves during investigations.

Cyber Awareness Month Offer: Upskill With 100+ Premium Cybersecurity Courses From EHA's Diamond Membership: Join Today